It’s time to face facts: the new sharing economy isn’t going away anytime soon. And car-sharing services, which empower smartphone wielding millennials to forgo the responsibilities (as well as the benefits) of personal car ownership in favor of “on demand” usage are expected to continue expanding in the coming year. For automakers looking (as always) to increase sales volumes, that would seem to be very bad news. But will the rising car-sharing economy really harm the American auto market, or will it simply lead its evolution?

Let’s break down some of the possibilities.

Fewer Car Sales: Fact or Fiction?

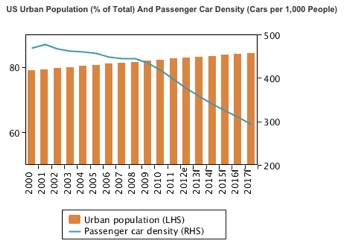

According to a recent report by the US Public Interest Research Group (PIRG) millennials are indeed moving away from car ownership in favor of peer-to-peer ride-share networks like Turo (formerly RelayRides) or mobility services such as Uber or Lyft. With rising ownership costs, increasing urbanization and a preference for technology being cited as key factors influencing this trend, BMI Research Group has, likewise, forecast that with increasing urbanization, the number of cars per 1,000 people in the US will continue to decline:

It would then appear that fewer car sales in the coming years is inevitable. But some analysts argue that increased car sharing does not necessarily mean fewer car sales. Indeed, according to one report by McKinsey & Company, while the ride-sharing economy may mean fewer cars on the road, the wear and tear on vehicles in use will increase (shrinking the timeframe of the vehicle-buying cycle). Moreover, the decline in personal ownership may raise demand for a greater variety of vehicles types available for rent or other short-term usage: “not only more utilitarian, almost ‘vandal-proof’ fleet cars for shared rides but also higher-performance ‘fun’ cars for those who still enjoy being behind the wheel for a Sunday drive.”

And what of the increased urbanization? While some speculate that public transportation in cities will continue to eat away at automakers’ bottom line, others acknowledge that unless the U.S. rapidly increases spending on transport infrastructure, increased urbanization may actually lead to a rise in auto purchases: if more consumers are looking to escape over-congested rail and bus services, car-sharing services will expand in response to that demand.

Trading on Technology

It’s undeniable that mobile technology has been the key to allowing the sharing economy to flourish, and automakers have been working on innovations in vehicle technology and in-car connectivity in an attempt to appeal to younger people. As polls have shown, millennials place greater value upon owning a smartphone and having internet access than upon owning a car—underscoring the idea that social networking has removed much of the need for face-to-face socializing which drove past generations to want their own transport. These innovations are certainly the future of the driving experience and many younger people will appreciate automakers’ determination to partner with Google and Apple to make cars an accessory to mobile tech. That being said, given the related costs of making “smarter” cars, it seems unlikely that trading on technology alone will be enough to turn millennials away from the sharing economy.

If You Can’t Beat ‘Em…

Rather than ignore, out-tech or out-market the ride-sharing trend, some automakers are looking to adapt to the new economy. In May 2015, for example, Ford Motor announced it would be rolling out its GoDrive program in London which offers consumers a pay-per-minute rental service using Ford’s managed network of publicly available rental vehicles. Then, in June, Ford doubled down on this foray into the sharing economy with the start of a test program, in partnership with online car-sharing service Getaround, which would allow people making monthly payments on a Ford-financed car to rent their cars out to third parties for up to a week at a time. This new program mirrors an earlier move into car-sharing by General Motors (GM), who, likewise, has been allowing car owners to rent their vehicles through the peer-to-peer network offered by RelayRides. Other car-sharing services offered by top automakers include car2go–run by Daimler AG (of car brands like Mercedes)—and Toyota’s sharing services using its electric i-Road vehicles in Tokyo and Grenoble, France.

It remains to be seen exactly how stepping into the realm of car-sharing and short-term rentals will benefit automakers—particularly when, in the case of rentals, the move makes automakers into direct competitors with big names like Avis and Budget. But, at the end of the day, it appears there’s more upside than down in this move—for both automakers and consumers. Joining in the sharing economy will not only provide an alternate revenue stream for automakers, it may also emerge as a way to showcase their vehicles to consumers who may be unfamiliar with a particular brand’s products. And by making ride-sharers more aware of the newest and best that vehicle manufacturers have to offer (particularly in the realm of electric and alternative fuel vehicles) who knows? Maybe a new generation of brand loyalists will be born, one ride at a time.